Annual Compliance for Private Companies

Mandatory ROC Filings and Statutory Duties for Active Status

Annual Compliance For Private Company

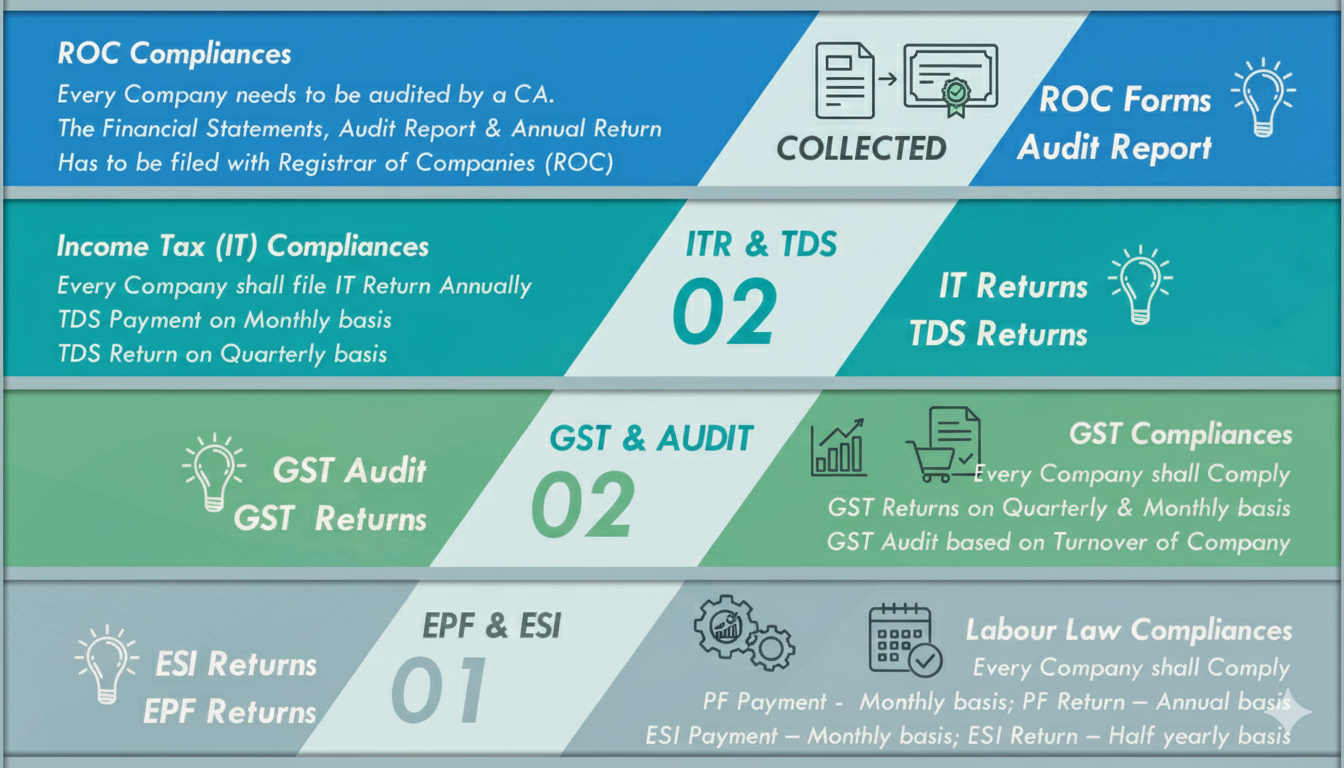

A private company is an entity enjoying a separate identity which requires maintaining its active status through the regular filing with MCA. For every company, it is compulsory to file an annual return and audited financial statements with MCA for every financial year. The RoC filing is mandatory irrespective of the turnover, whether it is zero or in crore. Whether a single transaction is undertaken or none, annual compliances for private limited are mandatory for every registered company.

Both the forms are filed to report the activities and financial date for concerned Financial Year. The due dates for annual filing of a company are based on the date of the Annual General Meeting. The continuous failure may lead to the removal of the company's name from RoC’s register, including disqualification of directors. Also, it has been observed that MCA has actively taken bold steps for dealing with any such failures.

Post-Incorporation & Annual Compliance for Companies

After incorporation, every company is required to comply with a set of statutory and regulatory obligations under the Companies Act, 2013. These compliances ensure legal validity, operational transparency, and smooth functioning of the company. Below are the key post-incorporation and annual compliances applicable to companies in India.

According to Section 173(1) of the Companies Act 2013, the company must arrange a first meeting with the Board of Directors within 30 days of its incorporation. The agenda of the meeting is to elect a chairman, appointment of the first auditor, register the company's address, maintain statutory registers, and disclose the interest of directors.

The auditor must be appointed by the Board of Directors within 30 days from the date of incorporation as per Section 139(1) of the Companies Act. If the Board fails to do so, an Extraordinary General Meeting must be organized to appoint an auditor within 90 days.

As per Section 184(1) of the Companies Act 2013, all directors must disclose their interests at the Board meeting and whenever there is any change. This ensures transparency and alignment with the company’s objectives, both individually and collectively.

According to the Companies Act, all official communications such as letterheads, billheads, notices, and other publications must contain mandatory information including:

- Name of the company

- Address of the registered office

- CIN (Corporate Identity Number)

- Phone number

- Email ID

- Website, if any

A company must also maintain statutory registers at its registered office, failure of which may attract penalties.

A company must open a bank account in its own name within 60 days from the date of incorporation so that all financial transactions can be properly recorded.

The company must issue share certificates to shareholders within 60 days from the date of incorporation or allotment. The certificate must include the following details:

- Shareholder’s name

- Share certificate number

- Face value of shares

- Total number of shares allotted

- Type of share (equity or preference)

- Amount received

After receiving the Certificate of Incorporation, directors must file Form INC-20A within 180 days with the Ministry of Corporate Affairs. This declaration confirms the commencement of business and requires that the subscribed share capital mentioned in the MOA has been deposited into the company’s bank account.

As per Section 128 of the Companies Act, every company must maintain proper books of accounts that present a true and fair view of its financial position. Accounting must follow the double-entry system and accrual basis.

Annual compliances must be completed within prescribed timelines after the end of each financial year. If the company is incorporated on or after January, the first financial year may extend up to 15 months. The first Annual General Meeting (AGM) must be held within 9 months from the end of the first financial year, and subsequent AGMs within 6 months.

Forms AOC-4 and MGT-7 must be filed with MCA within 30 days and 60 days respectively. AOC-4 includes audited financial statements and board reports, while MGT-7 contains details of shareholders and board meetings. Where applicable, Form DPT-3 must also be filed by 30th June for reporting outstanding loans or receipts not treated as deposits.

Summary of Penalties for Non-Compliance

| Compliance to be done | When is this compliance to be done? | Penalty for Non-compliance |

|---|---|---|

| 1. Issue of Share Certificates | The company must issue the Share Certificates to its shareholders within 2 months of its Incorporation or new allotment |

|

| 2. Statutory Registers | 7 to 8 Mandatory Registers to be maintained and updated from time to time |

|

| 3. Board Meeting Compliances |

|

|

| 4. Annual General Meeting (AGM) Compliance |

AGM to be held every year |

Default in holding AGM: Minutes Book Maintenance: |

|

5. Annual ROC Filings

|

Every company is required to file its Annual Return(MGT-7) with the ROC within 60 days of AGM. |

|

Simple & Transparent Pricing for Annual Compliance Private Company

Scale your features as your business grows. Find the plan that fits your needs today.

Basic Plan

Every month payment option Available. Prices are inclusive of GST

- Turnover less than 30 lakhs

- DIR 3 KYC of directors

- AOC-4 financial statement and other documents

- MGT-7 (annual return)

- ADT-1 if applicable

- INC-20A if applicable

- DPT-3 if applicable

- Board resolution preparation

- Directors report

- GST filing including GST 9

- Income Tax filing of Private Limited Company

- Assistance & filing of company audit report

- Book-Keeping and Accounting are not part of this package

Standard Plan

Every month payment option Available. Prices are inclusive of GST

- Turnover less than 60 lakhs

- DIR 3 KYC of directors

- AOC-4 financial statement and other documents

- MGT-7 (annual return)

- ADT-1 if applicable

- INC-20A if applicable

- DPT-3 if applicable

- Board resolution preparation

- Directors report

- GST filing including GST 9

- Income Tax filing of Private Limited Company

- Assistance & filing of company audit report

- Book-Keeping and Accounting are not part of this package

Premium Plan

Every month payment option Available. Prices are inclusive of GST

- Turnover less than 100 lakhs

- DIR 3 KYC of directors

- AOC-4 financial statement and other documents

- MGT-7 (annual return)

- ADT-1 if applicable

- INC-20A if applicable

- DPT-3 if applicable

- Board resolution preparation

- Directors report

- GST filing including GST 9 & 9C

- Income Tax filing of Private Limited Company

- Assistance & filing of company audit report

- Book-Keeping and Accounting are not part of this package

FAQ's on Annual Compliance For Private Company

Your Questions Answered

Which are the two main annual forms to be filed with the ROC?

A Private Limited Company must file two main forms with the Registrar of Companies (ROC) every year: Form AOC-4 (for filing Audited Financial Statements) and Form MGT-7 (for filing the Annual Return, which details the company's directorship and shareholding).

What is the deadline for holding the Annual General Meeting (AGM)?

The AGM must be held within six months from the end of the financial year. For a company closing its books on March 31st, the AGM must generally be held on or before September 30th. The first AGM must be held within 9 months of the first financial year end.

What is the due date for filing the Financial Statements (Form AOC-4)?

Form AOC-4 must be filed with the ROC within 30 days from the date on which the Annual General Meeting (AGM) was held.

What is the due date for filing the Annual Return (Form MGT-7)?

Form MGT-7 must be filed with the ROC within 60 days from the date on which the Annual General Meeting (AGM) was held.

Is a Statutory Audit mandatory for all Private Limited Companies?

Yes, a Statutory Audit by a Chartered Accountant is mandatory for every Private Limited Company from the very first year of incorporation, regardless of its turnover or volume of business. The audited financials must be filed with the ROC.

What is the Director KYC compliance?

Every person holding a Director Identification Number (DIN) must file Form DIR-3 KYC (or complete the web-based KYC) with the Ministry of Corporate Affairs (MCA) annually. The due date for this filing is generally September 30th of every year.

Is ITR filing mandatory even if the company has no business or loss?

Yes. All Private Limited Companies must compulsorily file their Income Tax Return in Form ITR-6 every year, regardless of whether they incurred a profit, a loss, or conducted zero business transactions.

What are the consequences of non-compliance with the Annual Filing?

Failure to file the mandatory forms (AOC-4 and MGT-7) results in a hefty penalty of ₹100 per day of delay for each form. Persistent non-compliance can lead to the company being marked as 'Inactive' or 'Struck Off' and the disqualification of its Directors.

Process of Annual Compliances for Private Limited Company

The process includes finalizing accounts, appointing an auditor, conducting an AGM, filing MCA forms (AOC-4 & MGT-7), and submitting income tax returns. Adhering to timelines ensures smooth compliance.

Annual Compliances for Private Limited Company

A Private Limited Company must file annual returns with MCA, financial statements, income tax returns, and conduct an AGM. Timely compliance avoids penalties and ensures legal standing.