Tax Collected at Source (TCS) Compliance

A guide to Seller responsibilities, rates, and thresholds for sale of goods.

What is TCS? (Tax Collected at Source)

The new provisions of TCS have come into force with effect from 1 October 2020 and according to it if your turnover is more than 10 crores in the previous financial year i.e. the year ended 31 March 2020, then this year you will have to collect and deposit TCS on your receipts from sale of goods from such buyers from whom you received more than Rs. 50 Lakhs as sale consideration during the current Financial year. The TCS is payable on the amount of receipt which is greater than 50 Lakhs and received after 1 st Oct. 2020. The rate of TCS is 0.1%.

New TCS Provision on Sale of Goods (w.e.f. Oct 1, 2020)

Applicability Criteria for Sellers:

- Seller Turnover: The Seller's total sales/gross receipts/turnover must exceed Rs 10 crores in the immediately preceding Financial Year.

- Buyer Threshold: TCS is collected only from Buyers from whom the Seller receives sale consideration exceeding Rs 50 Lakhs during the current Financial Year.

- Collection Basis: TCS is payable on the amount of receipt which is greater than Rs 50 Lakhs and received after October 1, 2020.

- TCS Rate: The standard rate of TCS is 0.1% (subject to change if PAN/Aadhaar is not provided).

TCS Rates for Specific Goods and Services (FY 2022-2023)

| Type of Goods/Contract | TCS Rate |

|---|---|

| Liquor of alcoholic nature, made for consumption by humans | 1.00% |

| Timber wood collected from a forest that has been leased | 2.50% |

| Tendu Leaves | 5.00% |

| Timber wood when not collected from a forest that has been leased, but any other mode | 2.50% |

| A forest product other than tendu leaves and timber | 2.00% |

| Scrap | 1.00% |

| Toll Plaza, Parking lot, Quarrying and Mining | 2.00% |

| Minerals (Lignite, Coal, or Iron Ore) | 1.00% |

| Bullion that exceeds over Rs. 2 lakhs Jewellery that exceeds over Rs. 5 lakhs. | 1.00% |

Simple & Transparent Pricing for Tcs Return Filing

Scale your features as your business grows. Find the plan that fits your needs today.

Basic Plan

inclusive of GST

- TCS return filing for one quarter.

- Import from any accounting software or excel.

- Manual data limited up to four deductions only.

- TCS certifiacate generation

- Traces validation

- Proper reconcialtion

Standard Plan

inclusive of GST

- TCS return filing for Two quarter.

- Import from any accounting software or excel.

- Manual data limited up to four deductions only.

- TCS certifiacate generation

- Traces validation

- Proper reconcialtion

Premium Plan

inclusive of GST

- TCS return filing for four quarter.

- Import from any accounting software or excel.

- Manual data limited up to four deductions only.

- TCS certifiacate generation

- Traces validation

- Proper reconcialtion

FAQ's on TCS Return Filing

Your Questions Answered

What is TCS (Tax Collected at Source)?

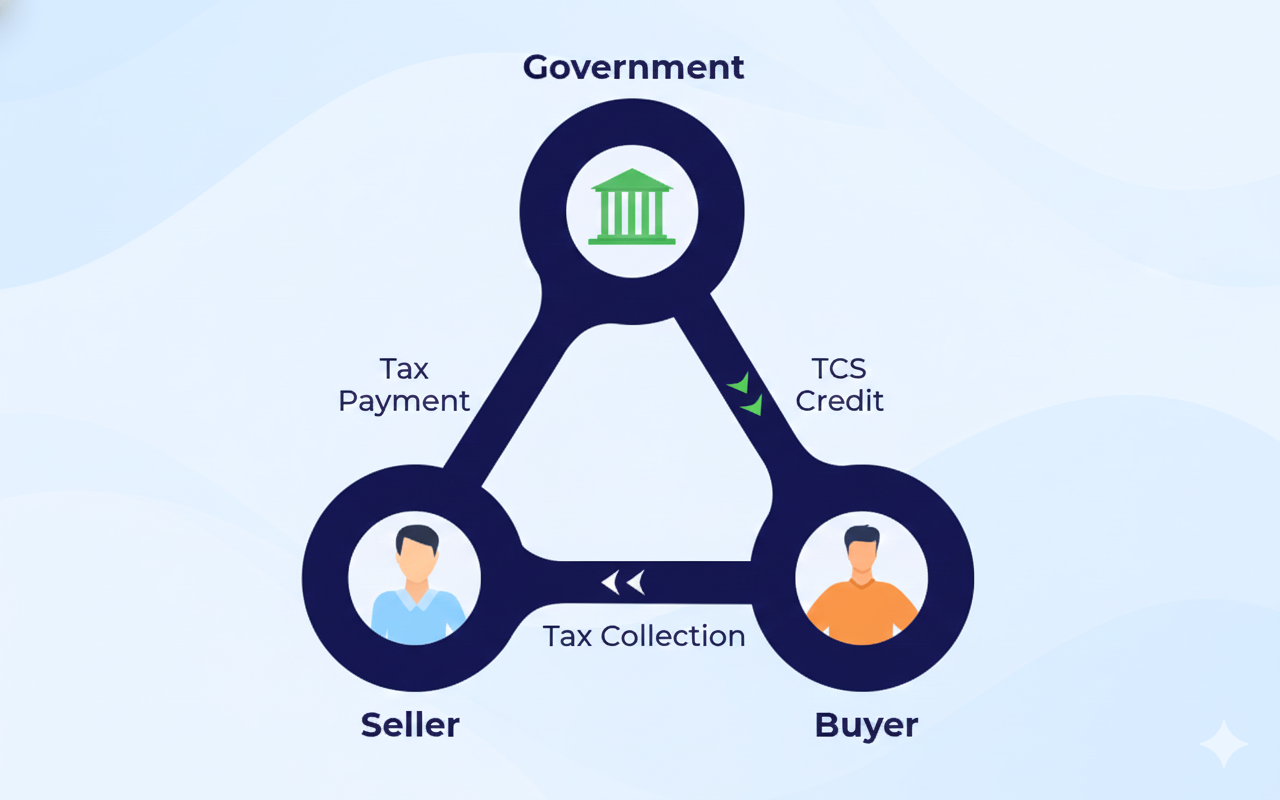

TCS is an amount collected by a seller from a buyer at the time of sale of specific goods (e.g., motor vehicles, scrap, certain minerals, or overseas remittances). The collected amount is deposited with the government by the seller on the buyer's behalf.

What is the key difference between TDS and TCS?

TDS (Tax Deducted at Source) is deducted by the payer (e.g., employer/company) from an expense payment (e.g., salary/fee). TCS is collected by the seller from the buyer at the point of sale/receipt of consideration for certain goods/transactions.

On which specific transactions is TCS applicable?

TCS is applicable on the sale of various goods/transactions, most commonly: 1) Sale of a Motor Vehicle exceeding ₹10 Lakh. 2) Sale of scrap, tendu leaves, timber, and certain minerals. 3) Overseas travel packages. 4) Foreign remittances under the Liberalised Remittance Scheme (LRS) exceeding prescribed thresholds.

What is the significance of the Collector having a TAN?

The Tax Deduction and Collection Account Number (TAN) is mandatory for any person responsible for collecting or deducting tax at source. The TAN must be quoted on all TCS payment challans and returns (Form 27EQ).

How does the buyer claim credit for the TCS collected?

The buyer (collectee) verifies the TCS collected on their behalf in their Form 26AS or Annual Information Statement (AIS). They claim this amount as a tax credit against their total income tax liability when filing their Income Tax Return (ITR).

What happens if a buyer fails to provide their PAN?

If a buyer (collectee) does not furnish their Permanent Account Number (PAN) to the collector (seller), the TCS must be collected at a higher rate—usually the higher of the prescribed rate or 5% (this rate varies depending on the specific section of the transaction).

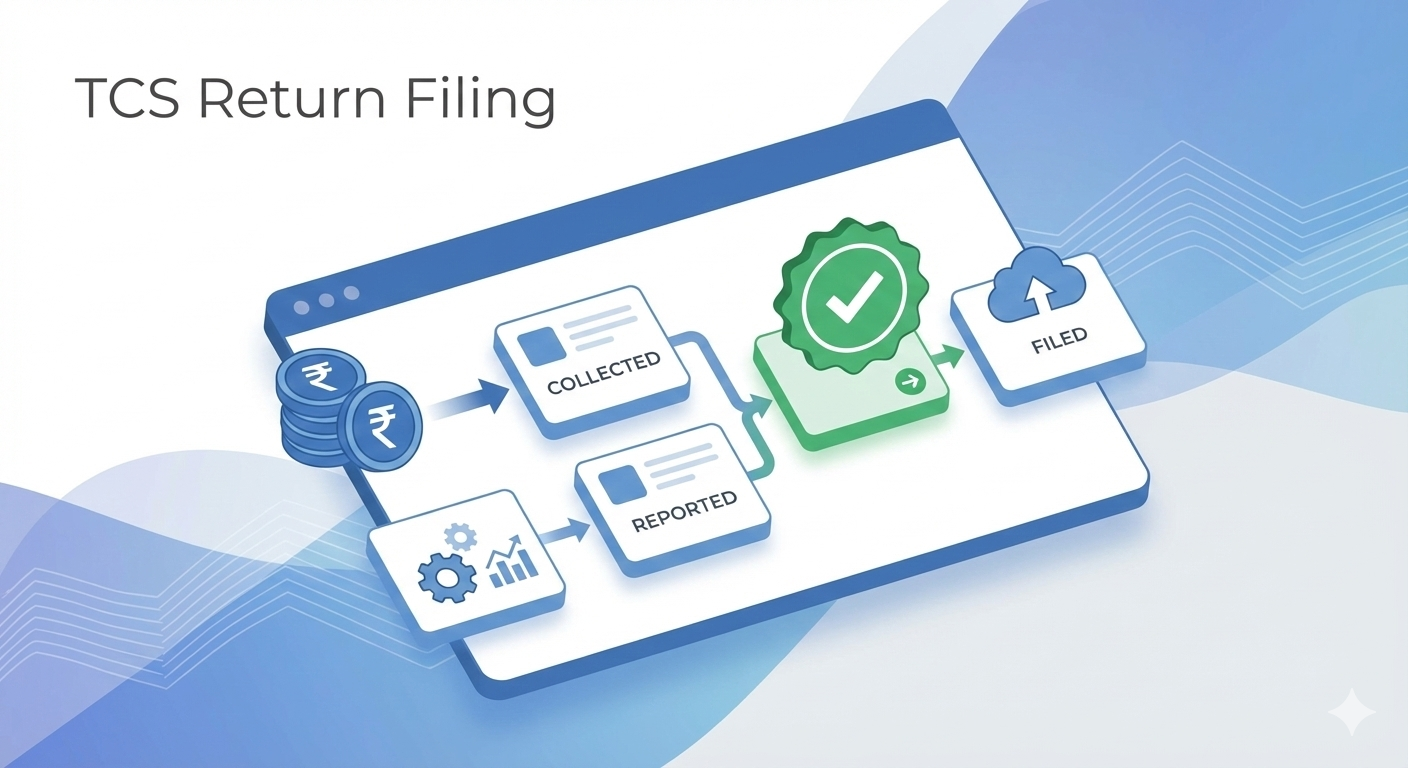

What is the due date for depositing TCS and filing returns?

The collected TCS amount must be deposited with the government using Challan 281 by the 7th day of the month following the month of collection. The seller must also file the quarterly TCS return in Form 27EQ by the prescribed due dates.

What is the TCS certificate provided to the buyer?

The seller (collector) must issue a certificate in Form 27D to the buyer (collectee) within 15 days of filing the quarterly TCS return. This certificate serves as proof of the tax collected and deposited.

TCS (Tax Collected at Source)

TCS is a tax levied on specific transactions where the seller collects an extra amount from the buyer at the time of sale and deposits it with the government.

TCS Payment & Credit

Seller collects TCS from buyer at sale and pays it to the government by the 7th of next month. The buyer can claim credit for this TCS (or a refund if excess) within the same financial year.